Women and Wealth: How to Build It

Written by Heidi I. Hartmann, Institute for Women's Policy ResearchWealth and assets are integral to the economic security of men and women of all ages, races, ethnicities, occupations, and income levels. Although women have made tremendous progress in achieving economic equality with men in all the largest racial and ethnic groups in the United States, they still lag behind men in many aspects of economic advancement. This lag leaves women to experience significantly less financial security and stability across their lifetimes, particularly when they head households on their own. Two periods of vulnerability in women’s lives stand out: first, when they are young and often having children without financial support from men, and, second, when they reach old age, after a lifetime of lower earnings, coupled with a greater commitment to caregiving, leaves them with fewer resources to support a longer lifetime.

Historically, marriage was a path to economic security for many women and is still a path to wealth accumulation. But this traditional role of marriage has been weakened by a dramatic increase in women’s labor force participation during the last half century, an increase in the average age of marriage, higher rates of non-marriage and single motherhood, the growing financial burdens of care (which fall disproportionately on the shoulders of women), and women’s greater longevity compared with men, which tends to leave them single in old age. Moreover, marriage is much less common today among low-income people and among people of color than it is among higher-income or white people. Today’s women spend less of their lives in marriage than their mothers did. And since marriage is often transitory and ends in divorce, long-term access to the assets accumulated in marriage is not guaranteed.1 Although increased education, employment, and earnings mean that many women can successfully support themselves and their children outside marriage, women’s economic vulnerabilities are generally greatest when they are single.

Women’s Income and Wealth

Both income and wealth are sources of financial security. Although we often focus mainly on income, accumulated wealth is of at least equal importance. For example, during the Great Recession, many working-age people used savings, including retirement savings, to tide them over, and they doubled up in housing and stopped saving for retirement. Women used all of these strategies, as well as borrowing against assets, more often than men.2 Women both earn less than men and have less wealth, and the gender wealth gap is larger than the gender wage gap. Although women earn only 78 percent of what men earn annually at the median, women’s wealth is only 32 percent of men’s wealth. With less income and less wealth, single women are clearly economically disadvantaged compared with single men.3

Native American women and black women experience the highest levels of poverty, 28 percent and 26 percent respectively, while white women and Asian/Pacific Islander women have lower poverty rates, at 12 percent and 13 percent, respectively.4 Within all major race/ethnic groups, women hold less wealth than men at the median. White men hold nearly twice the wealth of white women, while black men hold about 50 percent more than black women, and Hispanic men own nearly 10 times as much as Hispanic women. Among women, black women have about 1.3 percent of the wealth of single white women, and Hispanic women only about 0.6 percent.5

What are the causes of the gender gaps? Because of lower lifetime earnings — caused by both lower wages and more time spent out of the labor force on caregiving — women typically earn less, save less, and have lower wealth than men. Women’s poverty rates, based on their incomes, are much higher than men’s, not only because of their lower earnings but also because women more often raise children alone than men do. More mouths to feed on an equal income, and even more so on a lower income, translate into a higher poverty rate for women. Although women are poorer than men at every age, they are most disproportionately poor in the childbearing and childrearing years and again at older ages, when they are much more likely to be single.6

Women in the Childrearing Years

Two-fifths of births today are to unmarried women. Children contribute to women’s poverty and to their inability to acquire wealth while young, thus causing them to miss out on an important stage of wealth accumulation. Among household types, more than two in five (43 percent) single-female-headed households with children live below the poverty line. Compare this with the much lower poverty levels for single-male-headed households with children (24 percent) and of married couples with children (9 percent).7

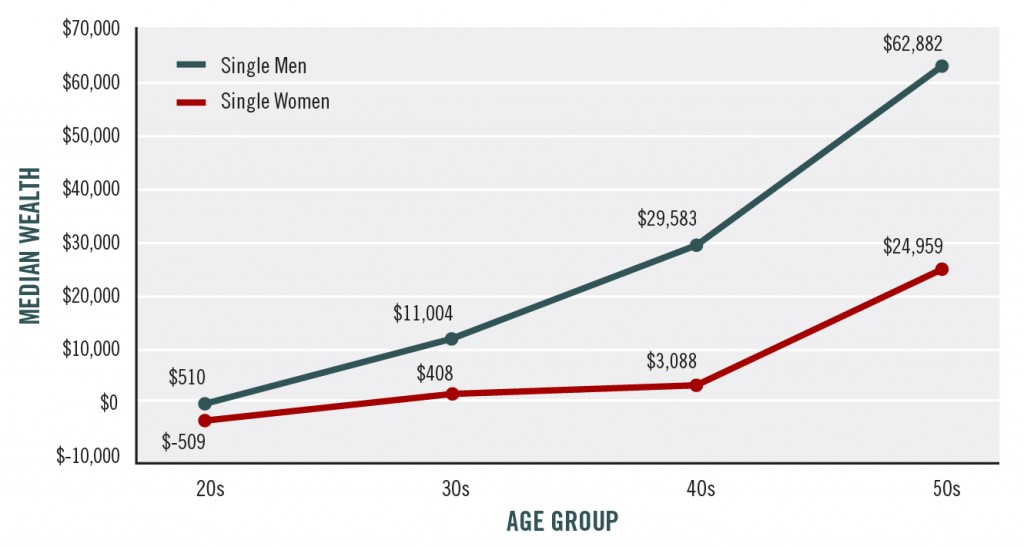

Note: Median wealth data are from the 2013 Survey of Consumer Finances in 2015 dollars converted by the author using the Consumer Price Index for All Urban Consumers, not Seasonally adjusted.

Source: Mariko Lin Chang, email communication, July 19, 2015.

Figure 1: Median Wealth by Gender and Age, 2013

Figure 1 illustrates how men’s wealth often accumulates rapidly when women’s does not. It shows what Mariko Lin Chang refers to as the effects of the “wealth escalator,” mechanisms that help people build wealth more quickly (including fringe benefits and government policies) and the consequent tendency for wealth to grow with age as the escalator operates.8 Note that men enter the escalator at a better place than women, with men in their twenties having $510 in wealth in 2013 compared with women’s negative wealth of -$509. By their thirties, single men had $11,004 compared with single women’s $408. Even by their forties women hold only $3,088 in wealth, while men’s wealth is $29,583.

In general, the ratio of women’s to men’s wealth is most unequal in the earlier age groups; this is significant because wealth that has been held the longest has the most chance to grow. Men are more likely to get early opportunities to save by working for employers who offer pensions or retirement savings plans and are also more likely to receive stock options. Both of these contribute to wealth directly. Women are nearly twice as likely as men to work part-time, and nine times as many women as men reported working part-time because of family care reasons.9 Working part-time makes it less likely that a worker will receive employment benefits that can help them save, such as paid vacation days, paid family or medical leave, paid sick days, health care insurance, and pensions or employer contributions to retirement saving funds. Because most of these employer benefits are tax-advantaged, the disparity in employer benefits is exacerbated by disparities in tax treatment that favor men.

Among both single and married parents, mothers still do the majority of family work, despite women’s increased participation in paid work, and fathers still do the majority of paid work outside the home, even though they have increased their time spent on family work somewhat. The difference in the labor force participation of fathers and mothers of children under age 6 is 27.3 percent nationally; 94.4 percent of fathers are in the labor force but only 67.1 percent of mothers are.10 Caring for children forces many women to choose between keeping their jobs and caring for their family, as quality child care is unaffordable for many families. Women who are working for pay and raising children on their own have less disposable income available for saving than their male or married counterparts, while those who are not working for pay lose access to employer-provided benefits; neither group is getting on the wealth escalator.

What is needed to help women get on the wealth escalator early and continue to move up? First, raising women’s earnings on the job is extremely important. Although young women earn nearly as much as young men when they first start out in the labor market, they fall behind rapidly in the childbearing years (and as we have seen, their wealth accumulation is negative in their twenties). Part of the reason may lie in the continued sex segregation of work, in which many women work in low-paid service jobs, including care work, jobs that are thought to be low paid at least in part because women do them; they also have little wage growth with increased years on the job.11 Many jobs that women dominate can be done on a part-time basis, allowing women to combine family care with some wage earning, but women often sacrifice access to pensions and paid leave when they work in part-time jobs. A policy change that could help young women in particular is requiring employers to provide the same wages and benefits on a proportional basis to part-time workers as they do to full-time workers, as is required in European Union member countries. Simply put, women need greater access to higher-paying and higher-quality jobs that are also family-friendly. Having access to equal retirement savings opportunities, for example, would help young women get on the wealth escalator early.

Stronger enforcement of Title IX of the Education Amendments of 1972, which applies to all educational programs (not only sports) from elementary school through graduate school, and improved information and counseling would likely help girls and young women prepare for higher-earning fields, and improved family policies on the job would make these higher-paid fields easier to navigate while raising a family. Improved information about earnings can also contribute to pay equity, since when workers know about unequal pay they are in a stronger position to do something about it. Stronger enforcement at the federal level of laws on equal pay (1963), equal employment opportunity (1964), and pregnancy discrimination (1978) is also essential.

Raising city, state, and federal minimum wage laws will also disproportionately help women, since women are more likely to work for the lowest wages. Achieving equal pay with men who are similarly qualified would raise women’s pay by thousands of dollars per year and reduce the poverty rate of families with a working woman (and single women) by half.12 Raising the salary threshold below which workers must receive premium pay for overtime work would also help women disproportionately.13 Collective bargaining also increases women’s pay and access to retirement benefits.14

Beyond increasing pay and benefits, income supports for times when workers cannot work are essential, especially because so many young women give birth when single. Paid leaves for both maternity disability and caregiving of newborns are essential to help increase women’s income security.15 Paid leaves also have the effect of increasing women’s job continuity, enabling them to build seniority on the job. Many wealthy countries provide paid leaves of 6–12 months or more, generally through a social insurance system. A fully paid caregiving leave of up to a year is one way to subsidize child care for infants. Beyond that age, the availability of subsidized child care must be increased, as other wealthy countries have been able to do. Indeed, if women’s caregiving work were fully compensated — through family caregiving leaves at full pay for sufficient time periods, more child-targeted public assistance (not only subsidized child care but also child allowances typically available in most other wealthy nations), as well as receiving more child support from absent fathers — women would be able to raise children without increasing their likelihood of living in poverty or reducing their ability to build wealth.

In addition, low-income women need to become familiar with ways to enhance their savings during their working years. For example the federal Savers Credit — which should be expanded — helps those with incomes up to $30,000 ($45,000 for heads of households) receive a tax credit for part of the first $2,000 they save for retirement.16 The Earned Income Tax Credit (EITC) rewards low-income adults, especially those with children, for working, and is another program that increases disposable income and the ability to save. Because women’s earnings are lower than men’s and they are more likely to be raising children, disproportionately more women receive EITC benefits.

And as Reggie Bicha and Keri Batchelder and others argue in this volume, federal assistance policy should allow low-income people to build up assets and not have to exhaust them in order to apply for food benefits such as SNAP and WIC or cash welfare assistance, programs that also disproportionately serve women. Those who are forced to exhaust their assets have a harder time climbing out of the situation that resulted in their needing assistance (for example, childbirth, an illness, a lost job). Even owning a modest value automobile, an asset that might be essential for these women to get back on the path toward earning better wages, can disqualify them for these crucial benefits.17

Women at Older Ages

Just as young women today do not face the same demographic and labor market conditions their mothers faced at comparable ages, today’s older women face different conditions in preparing for retirement than did their mothers. People are living longer and women especially more often face retirement unmarried. The substitution of defined-contribution for defined-benefit pension plans means that even those with access to employer-provided retirement savings plans are responsible for making contributions to the plans and decisions about how to invest the funds. And instead of receiving a predictable amount each month based on how much they earned and how many years they worked for a particular company, older workers’ retirement benefits are a function of past savings and investment returns.

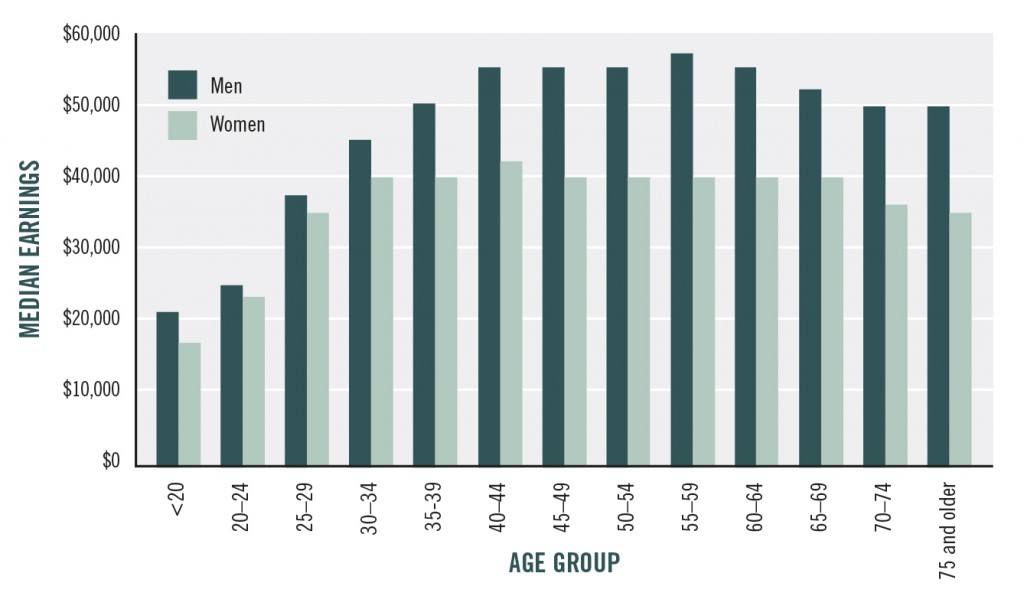

Figure 2 shows a marked difference in how men and women’s earnings grow with age.18 Women’s earnings are lower than men’s at every age and they also stop growing at about age 44, whereas men’s earnings for full-time, year-round work continue to grow to age 59. An Institute for Women’s Policy Research analysis found that women born in the late 1950s who worked full-time, year-round lost more than $500,000 compared with the earnings of men by age 59.19

Source: IWPR analysis of 2014 Current Population Survey Annual Social and Economic supplement microdata. (Earnings reported for 2013.) U.S. Census Bureau, “Current Population Survey Annual Social and Economic Supplement.”

Figure 2. Median Annual Earnings for Full-time, Year-round Workers by Sex and Age, 2013

As we have seen in the discussion of young women, having a job is important, but the quality of the job is often more critical for the wealth building that can make for financial security in the older years.20 Does the job provide wage gains with seniority on the job, a pension or contributions to retirement accounts, stock options, health insurance, tuition assistance or student loan forgiveness, paid sick days, help with child care and out-of-pocket health care costs, paid sick days, and paid family leave to care for an aging spouse or parent? While the majority of older women who worked full-time likely received basic benefits like health insurance and paid sick days through much of their working lives, many of today’s older women, especially those who worked part-time, have had little access to the type of employment-related benefits that would have enabled them to accumulate as much wealth as men their age have been able to do.

Like younger women, older women who are also providing caregiving do so at the detriment to their lifetime earnings and retirement savings. According to a 2013 AARP survey of people aged 45 to 74, women are three times more likely than men to quit their jobs due to caregiving.21 MetLife estimates those who quit will lose nearly $325,000 in earnings and benefits compared with those who are able to continue working.22

Although defined-contribution plans tend to be better than defined-benefit plans at accommodating workers who move from job to job or in and out of the labor force, they also leave workers with more uncertainty about their future income and a decreased likelihood of receiving benefits from a former, current, or deceased spouse. This is a feature especially important to women who have ever been married, who have less lifetime earnings but live longer than men on average. Policies that allow automatic enrollment encourage workers to participate in defined-contribution plans since workers have to opt out in order not to participate, but still only 48 percent of the workforce participates in any retirement plan at work. Participation rates are particularly low for part-time workers (19 percent), those in the bottom 25 percent of earnings (18 percent), those working in service occupations (21 percent), and those working in the leisure and hospitality industry (12 percent) — all areas in which women are overrepresented.23

Women who work full-time participate in employer-provided retirement plans at a slightly higher rate than male full-time workers (50.6 percent for women versus 46.5 percent for men in 2013).24 Nevertheless, because of lower earnings and more years in part-time work, when they may not have been eligible to participate, women’s accumulations in retirement accounts or their anticipated pension benefits are generally much smaller than men’s. Also, when women cash out their pension contributions when they change jobs, they are less likely than men to invest those funds and more likely to use them to pay for daily expenses.25 Policy attention must be turned toward new forms of pensions, such as those that simplify small business participation in pension plans. The federal myRA, described by Regis Mulot in this volume, is a promising federal initiative.

Even more important would be expansion of Social Security, this country’s one truly universal retirement plan. In 2012, women’s median Social Security benefits were $12,520 annually, compared with men’s of $16,398.26 Expanding Social Security benefits in ways that especially help women would address their lower benefits. A glaring hole in Social Security is that it fails to acknowledge women’s contributions to the economy in the form of caring labor. Providing women with added earnings credits during caregiving years, although they might not have worked for pay then, would help raise women’s retirement incomes, just as it does in most of the other Organisation for Economic Co-operation and Development (OECD) countries that already have such benefits. Social Security provides many family benefits that are very valuable to women, such as benefits from husbands’ work records, which are often higher than women’s own worker benefits. This family-friendliness could be enhanced for married women who have worked most of their lives by raising their benefits if their husbands predecease them. Many public interest groups are calling for increases in Social Security benefits, both those of a more universal nature and those targeted at especially vulnerable populations, including women.27 Several candidates in the current presidential primary season are also exploring ways to increase benefits, as well as ways to pay for those increased benefits. According to a survey from the National Academy of Social Insurance, three-quarters of Americans think an increase in benefits should be considered, and most Americans support the elimination of the cap on taxable earnings, now $118,500. 28

Conclusion

The undervaluation of caring work and women’s disproportionate responsibility for it is a central factor affecting women’s lower incomes and smaller net worth. The vast majority of both paid and unpaid care workers in the home, as well of care recipients, are women. This caring labor is essential for society, but better ways of relieving women’s excess responsibility for it are desperately needed if we want to see greater equity in the wealth attained by men and women and more fulfilling lives for all genders. As Amartya Sen noted in his 1999 book, Development as Freedom, we must address the specific barriers women face due to social, institutional, and environmental factors, such as the commonly accepted division of labor between women and men and the many forms of discrimination against women.

If our society hopes to equalize wealth between women and men, two preconditions are necessary. First, women and men must have equal lifetime earnings, and, second, women must not bear the lion’s share of the burden of the uncompensated and poorly compensated care work required by our society. Those who do caring labor must be fully compensated through paid leaves, child allowances, and ample subsidies for child care and elder care. The United States is the only economically advanced country in the world that does not have a system of national paid maternity leave; many other well-off countries also provide parental (or caring) leaves to both mothers and fathers. Paid family leave is a vital policy that would keep young adults from falling into financial insecurity when they form families and go a long way toward helping them build a life of financial security for themselves and their children.

Improving the treatment of caring labor would also improve women’s financial security during their retirement years. For example, if access to employer-provided retirement plans were increased for part-time workers, then women who work part-time for family care reasons would have access to easier forms of retirement savings. If child care and elder care assistance were increased, fewer adult caregivers would have to work part-time; full-time work would not only likely increase their eligibility to participate in employer-provided retirement plans, but also increase their earnings, contributions, and benefits accordingly. Adding a caregiving credit in Social Security would also increase retirement income for women and men who work less or leave the labor market entirely for a period of years in order to provide care to a family member.

From a base of equal lifetime incomes, no discrimination against women, and equalized and fully compensated caregiving burdens, it should be easier to encourage women to build wealth in the same ways as men or to improve upon men’s record. Indeed, as we have seen, among full-time workers, women are now participating in employer-offered pension/savings plans at a slightly higher proportion than men. Women seem to have a higher propensity to save, all else equal, perhaps in preparation for an anticipated longer retirement.

In these and other ways, the United States could ensure that women have a more equal chance to build wealth and enjoy an increase in their well-being and financial security. Women’s increased well-being would also give their children a better start in life and increase their financial stability throughout childhood, helping them launch more successfully into adulthood. Building wealth for women is truly a two-generation strategy.

NOTES

- The right of women, and especially married women, to hold assets in their own name arrived rather late in the development of capitalism. It began in the United States in the 1840s and 1850s with the passage of Married Women’s Property Acts in state after state, but the process was not fully complete until the late 1800s. It was not until the passage of the Equal Credit Opportunity Act in 1974 that single and married women gained the right to hold credit cards in their own names–without “responsible” cosigners. Community property states, with laws based more on continental Europe, tend to be more favorable to women’s rights to marital property upon divorce than those more firmly based on English Common law. See Carmen Dianna Deere and Cheryl Doss, “The Gender Asset Gap: What Do We Know and Why Does It Matter,” Feminist Economics 12 (1–2) (2006): 1–50.

- In 2010, 45 percent of women and 38 percent of men reported having taken money out of their savings or retirement fund in the past year. Doubling up refers to taking in or moving in with new household members in order to cope financially. Since 2007, 17 percent of women and 11 percent of men reported having doubled up. In 2010, 33 percent of women and 27 percent of men reported having stopped or reduced their contributions to retirement savings over the past year. In addition, 13 percent of women and 12 percent of men said they had borrowed against a retirement plan. Data are from the 2010 IWPR/Rockefeller Survey of Economic Security. See Jeff Hayes and Heidi Hartmann, “Women and Men Living on the Edge: Economic Insecurity After the Great Recession” (Washington, DC: Institute for Women’s Policy Research, 2011).

- Wage data are based on 2013 medians from the Current Population Survey for full-time, year-round workers ages 16 and over. Wealth data are based on median wealth from the Survey of Consumer Finance in 2013 for single women and men ages 18–64. Data on wealth are for single women and men only and refer to the value of assets net of debts. See Ariane Hegewisch, Emily Ellis, and Heidi Hartmann, “The Gender Wage Gap: 2014; Earnings Differences by Race and Ethnicity.” Fact Sheet. (Washington, DC: Institute for Women’s Policy Research, 2015); Mariko Lin Chang, “Women and Wealth: Insights for Grant Makers” (Asset Funders Network, 2015).

- Cynthia Hess, Jessica Milli, Jeff Hayes, and Ariane Hegewisch, “Status of Women in the States 2015.” (Washington, DC: Institute for Women’s Policy Research, 2015).

- Chang, “Women and Wealth.” Comparing Chang’s 2013 analysis with her earlier analysis of the 2004 Survey of Consumer Finances indicates that in constant dollars, minority men and women generally lost huge portions of their income and wealth in the Great Recession; black men lost about 95 percent of their income, and black women more than 90 percent; Hispanic men lost more than half of their 2004 wealth, while Hispanic women increased their median wealth from $0 to $102 by 2013.

- IWPR analysis of US Census Bureau, “Annual Social and Economic Supplement 2014,” Current Population Survey.

- Hess et al., “Status of Women in the States.”

- Mariko Chang, Shortchanged: Why Women Have Less Wealth and What Can Be Done About It (New York: Oxford University Press, 2010).

- Hess et al., “Status of Women in the States.”

- Ibid.

- Improving the pay, benefits, and working conditions of home care and home health aides would raise the incomes specifically of the many minority women in these jobs, increase their disposable income, and allow them to save more. Higher pay and benefits would also reduce turnover in these jobs and increase the quality of care disabled and older adults receive. Truly valuing caregiving would lift the pay of many occupations such as these. These are occupations that are expected to grow more rapidly than the labor force as a whole since the need for caregiving will expand as the population ages.

- Heidi Hartmann, Jeffrey Hayes, and Jennifer Clark, “How Equal Pay for Working Women Would Reduce Poverty and Grow the American Economy.” (Washington, DC: Institute for Women’s Policy Research, 2014).

- Heidi Hartmann et al., “How the New Overtime Rule Will Help Women and Families.” (Washington, DC: Institute for Women’s Policy Research and MomsRising, 2015).

- Julie Anderson, Ariane Hegewisch, and Jeff Hayes, “The Union Advantage for Women.” (Washington, DC: Institute for Women’s Policy Research, 2015).

- A growing number of local and state governments require that employers provide paid sick days, and three states (California, New Jersey, and Rhode Island) require employers to participate in worker-funded social insurance plans that provide paid family leave, albeit only for 4–6 weeks (these three states plus Hawaii and New York also provide social insurance for nonwork-related disabilities up to 26–52 weeks).

- Internal Revenue Service, “Save Twice with the Saver’s Credit,” IRS Special Edition Tax Tip 2014–22.

- It is interesting that other policies that raise the incomes of the poor do not have asset limits. The minimum wage is neither income- nor asset-tested (all workers are eligible for it), while the federal Earned Income Tax Credit (EITC) is only income-tested and has no asset limits.

- The data shown in Figure 2 are cross-sectional, showing different age groups at one point in time. Similar age earnings profiles are found when using longitudinal data that follow the same workers across time. See Stephen J. Rose and Heidi Hartmann, “Still a Man’s Labor Market: The Long-Term Earnings Gap” (Washington, DC: Institute for Women’s Policy Research, 2004).

- Hess et al., “Status of Women in the States.”

- Chang, Shortchanged.

- Rebecca Perron, “Staying Ahead of the Curve 2013: The AARP Work and Career Study.” (Washington, DC: AARP, 2014).

- MetLife, “The MetLife Study of Caregiving Costs to Working Caregivers: Double Jeopardy for Baby Boomers Caring for Their Parents.” (Westport, CT: MetLife, 2011).

- U.S. Department of Labor, “National Compensation Survey” (Washington, DC: Bureau of Labor Statistics, 2014).

- IWPR analysis of 2014 Current Population Survey Annual Social and Economic supplement microdata, (Participation rate reported for 2013).

- Lois Shaw and Catherine Hill, “The Gender Gap in Pension Coverage: What Does the Future Hold?” (Washington, DC: Institute for Women’s Policy Research, 2002).

- Social Security Administration, Fact Sheet: Social Security Is Important to Women.

- Maya Rockeymoore and Meizhu Lui, “Plan for a New Future: The Impact of Social Security Reform on People of Color.” (Washington, DC: Commission to Modernize Social Security, 2011); Carroll L. Estes, Terry O’Neill, and Heidi Hartmann, “Breaking the Social Security Glass Ceiling: A Proposal to Modernize Women’s Benefits.” (Washington, DC: National Committee to Preserve Social Security and Medicare Foundation, 2012); National Council of Women’s Organizations and Center for Community Change, “Expanding Social Security Benefits for Financially Vulnerable Populations.” (Washington, DC: Center for Community Change, 2013).

- Jasmine V. Tucker, Virginia P. Reno, and Thomas N. Bethell, “Strengthening Social Security: What Do Americans Want?” (Washington, DC: National Academy of Social Insurance, 2013).